Taxation

(Partnerships – Economic Substance) (Jersey) Law 2021

A LAW to impose an economic substance

test on Jersey resident partnerships.

Commencement [see endnotes]

PART 1

Interpretation

1 Interpretation – general[1]

In this Law –

“1961 Law” means the Income Tax

(Jersey) Law 1961;

“authorised person” means the Comptroller or any

person authorised by the Comptroller to perform functions under Article 14;

“banking business” –

(a) means, in respect of a person,

a deposit taking business that the person must be registered to carry on under Article 9

of the Banking Business

(Jersey) Law 1991; but

(b) does not include business

carried on by a person which the Jersey Financial Services Commission is

satisfied is registered under the Banking

Business (Jersey) Law 1991 solely for

business continuity and liable to pay a reduced annual fee accordingly under

the Commission’s published fees under Article 15 of the Financial

Services Commission (Jersey) Law 1998;

“Comptroller” means the Comptroller of Revenue

described in Article 2 of the Revenue

Administration (Jersey) Law 2019;

“connected person”, in relation to a resident

partnership, means –

(a) an individual who is –

(i) a partner in the

resident partnership, or

(ii) the spouse, civil

partner, sibling, ancestor or lineal descendant of a partner in the resident

partnership; or

(b) another partnership or

person (the “other entity”) if the resident partnership and the other

entity –

(i) are both controlled by

the same person, either alone or with other persons to whom the person is connected

in accordance with this definition or with Article 3A(2), (4) or (5) of

the 1961 Law, or

(ii) are both controlled by

groups of 2 or more persons and the groups either consist of the same persons

or could be regarded as consisting of the same persons by treating (in one or

more cases) a member of either group as replaced by a person with whom the

member is connected in accordance with this definition or with Article 3A(2),

(4) or (5) of the 1961 Law;

“core income-generating activities” has the

meaning given in Article 5;

“deposit-taking business” has the meaning given

in Article 3 of the Banking Business

(Jersey) Law 1991;

“distribution and service centre business” –

(a) means the business

of –

(i) purchasing, from foreign

connected persons, goods ready for sale or component parts or materials for

goods and then reselling those component parts, materials or goods, or

(ii) providing services to

foreign connected persons in connection with such a business; but

(b) does not include any

activity included in any other relevant activity except holding partnership

business;

“economic substance test” means the test in Article 8(1);

“finance and leasing business” has the meaning

given in Article 3;

“financial period” has the meaning given in Article 4A

of the 1961 Law;

“foreign connected person”, in relation to a

resident partnership, means a person or partnership that is –

(a) a connected person of the

resident partnership; and

(b) not resident or regarded

as resident in Jersey;

“foreign limited partnership” means a

partnership that –

(a) was established under the

Law of a jurisdiction outside of Jersey; and

(b) consists of one or more

persons who are general partners and one or more persons who are limited

partners;

“fund management business” means –

(a) the business of a manager

or investment manager referred to in Group 2 in Part 2 of the Schedule to

the Collective

Investment Funds (Jersey) Law 1988 who

is required to hold a permit under that Law to carry on the business;

(b) the business of a person

who is required to be registered under the Financial

Services (Jersey) Law 1998 to carry on

financial service business (as defined in Article 2 of that Law) and who

is –

(i) a manager or investment

manager referred to in Article 2(10)(a) of that Law,

(ii) a trustee referred to in

Article 2(10)(c) of that Law, except where a separate manager has been

appointed to the fund, or

(iii) a member of a partnership

referred to in Article 2(10)(d) of that Law, except where a separate

manager has been appointed to the fund;

(c) the business of being a

person who is the equivalent of a person referred to in paragraph (b) in

respect of a fund that would be a scheme falling within the definition of

“collective investment fund” in Article 3 of the Collective

Investment Funds (Jersey) Law 1988

except that the offer of units in the scheme or arrangement is not an offer to

the public within the meaning of that Article; or

(d) the business of being a

person who is the equivalent of a person referred to in paragraph (b) in

respect of a fund that –

(i) is not for the purpose

of securitisation or repackaging of assets, and

(ii) would be a scheme

falling within the definition of “collective investment fund” in Article 3

of the Collective

Investment Funds (Jersey) Law 1988

except that the fund is prescribed not to constitute a collective investment

fund in an Order made for the purposes of paragraph (7) of that Article;

“general partner” means a partner that is not a

limited partner;

“headquarters business” –

(a) means the business of

providing any of the following services to one or more foreign connected

persons of the resident partnership –

(i) the provision of senior

management,

(ii) the assumption or

control of material risk for activities carried out by, or assets owned by, any

of those connected persons, or

(iii) the provision of

substantive advice in connection with the assumption or control of risk referred

to in sub-paragraph (ii); but

(b) does not include anything

falling within the definition of finance and leasing business, intellectual

property holding business, insurance business or banking business;

“high risk IP partnership” means a partnership

that carries on an intellectual property holding business and –

(a) the partnership –

(i) did not create the

intellectual property in an intellectual property asset which it holds for the

purposes of its business,

(ii) acquired the

intellectual property asset –

(A) from a connected person,

or

(B) in consideration for

funding research and development by another person situated in a country or

territory other than Jersey, and

(iii) licences the intellectual

property asset to one or more connected persons or otherwise generates income

from the asset in consequence of activities (such as facilitating sale

agreements) performed by foreign connected persons; or

(b) the partnership does not

carry out research and development, branding or distribution as part of its

core income-generating activities;

“holding body” has the meaning given in Article 2

of the Companies

(Jersey) Law 1991, except that in that Article –

(a) “body corporate” is to be

read as including a limited liability partnership registered under the Limited

Liability Partnerships (Jersey) Law 2017; and

(b) paragraph (1) (which

defines “subsidiary”) is to be read with the necessary modifications so that it

could apply to a limited liability partnership;

“holding partnership” means a resident

partnership which –

(a) is a holding body;

(b) has as its primary

function the acquisition and holding of shares or equitable interests in

companies; and

(c) does not carry on any

commercial activity;

“holding partnership business” means the

business of being a holding partnership;

“income”, in respect of an intellectual property

asset, includes –

(a) royalties;

(b) income from a franchise

agreement; and

(c) income from licensing the

intangible asset;

“incorporated limited partnership” means an

incorporated limited partnership established in accordance with the Incorporated

Limited Partnerships (Jersey) Law 2011;

“insurance business”, in respect of a person, means

long-term business or general business within the meaning of Article 1 of

the Insurance

Business (Jersey) Law 1996 which person must be authorised to

carry on by a Category A permit or Category B permit under that Law;

“intellectual property holding business” means the

business of holding or exploiting intellectual property assets;

“intellectual property asset” means any

intellectual property right in intangible assets, including but not limited to

copyright, patents, trade marks, brand, and technical

know-how, from which identifiable income accrues to the business (such income

being separately identifiable from any income generated from any tangible asset

in which the right subsists);

“limited liability partnership” means a limited

liability partnership registered under the Limited

Liability Partnerships (Jersey) Law 2017 or a foreign limited

liability partnership approved by the Comptroller under Article 76E of the

1961 Law;

“limited partner” means a partner whose liability

towards the partnership’s debts is legally limited;

“limited partnership” means a limited

partnership established in accordance with the Limited

Partnerships (Jersey) Law 1994;

“Minister” means the Minister for Treasury and

Resources;

“partner”, in relation to a partnership, means

any partner in the partnership (regardless of whether the partner is a general

partner or limited partner);

“partnership” includes –

(a) an

incorporated limited partnership;

(b) a limited

liability partnership;

(c) a limited partnership;

(d) a separate limited

partnership;

(e) a foreign limited

partnership;

(f) a general partnership

within the meaning of Article 3 of the 1961 Law;

“relevant activities” has the meaning given in Article 4;

“resident partnership” has the meaning given in Article 2;

“separate limited partnership” means a separate

limited partnership established in accordance with the Separate Limited

Partnerships (Jersey) Law 2011;

“ship” has the meaning given in Article 1

of the Shipping (Jersey)

Law 2002 but does not include –

(a) a fishing vessel (as

defined by that Article);

(b) a small ship (as defined

by that Article); or

(c) a ship to the extent that

it is used as a pleasure vessel (as defined by Article 169(6) of that

Law);

“shipping business” means any of the following

activities involving the operation of a ship anywhere in the world other than

solely between Jersey and Guernsey or within the territorial waters of Jersey –

(a) the business of

transporting, by sea, persons, animals, goods or mail;

(b) the renting or chartering

of ships for the purpose described in paragraph (a);

(c) the sale of travel

tickets or equivalent, and ancillary services connected with the operation of a

ship;

(d) the use, maintenance or

rental of containers, including trailers and other vehicles or equipment for

the transport of containers, used for the transport of anything by sea;

(e) the management of the

crew of a ship.

2 Meaning of “resident partnership”

(1) A

partnership formed under Jersey law is a resident partnership unless its place

of effective management is outside of Jersey in a country or territory

where –

(a) the highest rate at which

a company or individual may be charged to tax on any part of its income is 10%

or higher; or

(b) the partnership is

required to satisfy a test that is substantially the same as the economic

substance test.

(2) A

partnership not formed under Jersey law is a resident partnership if its place

of effective management is in Jersey.

(3) In

this Article –

(a) a partnership’s place of

effective management is the place where key management and commercial decisions

that are necessary for the conduct of the partnership’s business as a whole are

in substance made; and

(b) a partnership will have

one place of effective management at any one time (even if there is more than

one place where management decisions are made).

(4) The

Comptroller –

(a) may issue guidance on the

meaning of “place of effective management”; and

(b) must publish any guidance

issued (and any amendments to the guidance) in a manner which the Comptroller

considers will bring it to the attention of those most likely to be affected by

it.

(5) In

determining the meaning of “place of effective management”, a person must have

regard to any guidance issued under paragraph (4).

3 Meaning of “finance and leasing

business”

(1) In

this Law, “finance and leasing business” –

(a) means the business of

providing credit facilities of any kind for consideration; but

(b) does not include any

activity falling within the definition of “banking business”, “fund management

business” or “insurance business”.

(2) For

the purposes of paragraph (1) but without limiting the generality of that

paragraph –

(a) consideration may include

consideration by way of interest;

(b) the provision of credit

may be by way of instalments for which a separate charge is made and disclosed

to the customer in connection with –

(i) the supply of goods by

hire purchase,

(ii) leasing other than any

lease granting an exclusive right to occupy land, or

(iii) conditional sale or

credit sale.

(3) Where

an advance or credit repayable by a customer to a person is assigned to another

person or partnership, that other person or partnership is deemed to be

providing the credit facility for the purposes of paragraph (1).

4 Meaning of “relevant activities”

(1) In

this Law, “relevant activities” means any of the following activities –

(a) banking business;

(b) distribution and service

centre business;

(c) finance and leasing

business;

(d) fund management business

(e) headquarters business;

(f) holding partnership

business;

(g) insurance business;

(h) intellectual property

holding business;

(i) shipping business.

(2) However,

“relevant activities” does not include –

(a) business conducted by a

collective investment fund (as defined in the Collective

Investment Funds (Jersey) Law 1988);

(b) business conducted by a

fund that would be a collective investment fund except that the offer of units

in the fund is not an offer to the public (within the meaning given in Article 3

of the Collective

Investment Funds (Jersey) Law 1988); or

(c) business conducted by a

fund that –

(i) is not for the purpose

of securitisation or repackaging of assets, and

(ii) would be a collective

investment fund except that the fund is prescribed not to constitute a

collective investment fund in an Order made for the purposes of Article 3(7)

of the Collective

Investment Funds (Jersey) Law 1988.

(3) If

a partner in a partnership has been required to satisfy the economic substance

test in this Law or in the Taxation (Companies –

Economic Substance) (Jersey) Law 2019 in relation to an activity

(the “partner’s activity”), then for the purpose of determining whether an activity

carried on by or through the partnership is a relevant activity, the

definitions of the terms listed in paragraph (1) must be read as if the

partner’s activity was undertaken by the partnership.

5 Meaning of “core income-generating

activity”

In this Law, “core

income-generating activity” includes any of the following activities –

(a) in respect of banking

business –

(i) raising funds or

managing risk, including credit, currency and interest risk,

(ii) taking hedging

positions,

(iii) providing loans, credit

or other financial services to customers,

(iv) managing capital and

preparing reports and returns to the Jersey Financial Services Commission or any body or entity with equivalent functions relating to

the supervision or regulation of such business;

(b) in respect of

distribution and service centre business –

(i) transporting and storing

goods, components and materials,

(ii) managing stocks,

(iii) taking orders,

(iv) providing consulting or

other administrative services;

(c) in respect of finance and

leasing business –

(i) agreeing funding terms,

(ii) identifying and

acquiring assets to be leased (in the case of leasing),

(iii) setting the terms and

duration of any financing or leasing,

(iv) monitoring and revising

any agreements,

(v) managing any risks;

(d) in respect of fund

management business –

(i) taking decisions on the

holding and selling of investments,

(ii) calculating risk and

reserves,

(iii) taking decisions on

currency or interest fluctuations and hedging positions,

(iv) preparing reports and

returns to investors and the Jersey Financial Services Commission or any body or entity with equivalent functions relating to

the supervision or regulation of such business;

(e) in respect of

headquarters business –

(i) taking relevant

management decisions,

(ii) incurring expenditures

on behalf of group entities,

(iii) co-ordinating group

activities;

(f) in respect of holding partnership

business, all activities related to that business;

(g) in respect of insurance

business –

(i) predicting and calculating

risk,

(ii) insuring or re-insuring

against risk and providing insurance business services to clients;

(h) in respect of

intellectual property holding business –

(i) taking strategic

decisions and managing (as well as bearing) the principal risks related to

development and subsequent exploitation of the intangible asset generating

income,

(ii) taking the strategic

decisions and managing (as well as bearing) the principal risks relating to

acquisition by third parties and subsequent exploitation and protection of the

intangible asset,

(iii) carrying on the

underlying trading activities through which the intangible assets are exploited

leading to the generation of revenue from third parties,

(iv) research and development,

branding or distribution;

(i) in respect of shipping

business –

(i) managing crew (including

hiring, paying and overseeing crew members),

(ii) overhauling and

maintaining ships,

(iii) overseeing and tracking

deliveries,

(iv) determining what goods to

order and when to deliver them, organising and overseeing voyages.

6 Liability of partners - partnerships without separate legal

personality

(1) This

Article applies in respect of a partnership that does not have separate legal

personality.

(2) A

requirement in this Law for the partnership to take an action is a requirement

for the general partners in the partnership to take that action, and all general

partners are jointly liable for any penalty resulting from a failure for the

action to be taken.

PART 2

Economic

substance test

7 Who must meet economic substance test

(1) Unless

an exception in this Article applies, a resident partnership must satisfy the

economic substance test in relation to any relevant activity carried on by or

through it for which it has gross income.

(2) A

resident partnership is not required to satisfy the economic substance test in

relation to a relevant activity carried on by or through it if all of the

partners in the partnership are individuals who are subject to income tax in

Jersey.

(3) A resident partnership is not required to

satisfy the economic substance test in relation to a relevant activity carried

on by or through it in a financial period if, during that financial

period, –

(a) the resident partnership

is not part of a multinational group; and

(b) the resident partnership

does not undertake business activities outside of Jersey.

(4) A resident partnership is part of a

multinational group if –

(a) under international

accounting standards, the partnership’s income and expenses would be a part of

the consolidated results of a group of enterprises; and

(b) one or more of the

persons or partnerships in the group –

(i) is not a tax resident in

Jersey, or

(ii) has one or more

permanent establishments outside of Jersey.

(5) In this Article, –

“international accounting standards”

means the International Financial Reporting Standards set by the International

Accounting Standards Board;

“permanent establishment”, in

relation to a person or partnership, includes a branch, a factory, shop,

workshop, quarry or a building site, and a place of management of the person or

partnership;

“undertake business activities”,

in relation to a resident partnership, –

(a) means performing services

for customers, or manufacturing or producing goods for sale to or for use by

customers, regardless of whether the service is performed or the goods are

manufactured or produced –

(i) wholly or in part, or

(ii) through a permanent

establishment of the resident partnership; but

(b) does not include

performing services for the benefit of the resident partnership, rather than a

customer.

8 Economic substance test

(1) A

partnership meets the economic substance test in relation to a relevant

activity if –

(a) it is managed in Jersey

in relation to that activity;

(b) having regard to the

level of relevant activity carried on in Jersey –

(i) there are an adequate

number of people performing work in relation to that activity who are

physically present in Jersey (whether partners or employees, whether employed

by the resident partnership or another entity or partnership and whether on

temporary or long-term contracts),

(ii) there is adequate

expenditure incurred in Jersey, and

(iii) there are adequate

physical assets in Jersey;

(c) all of the partnership’s

core-income generating activities are carried out in Jersey; and

(d) the partnership’s

governing body is able to monitor and control the carrying out of core

income-generating activities carried out in Jersey for the partnership by

another entity or partnership (if any).

(2) A

partnership is managed in Jersey in relation to an activity if –

(a) the partnership’s

governing body meets in Jersey at an adequate frequency having regard to the

amount of decision-making required at that level;

(b) the majority of the

partnership’s governing body are physically present at those meetings;

(c) records are kept of the

strategic decisions made at those meetings;

(d) the members of the

governing body, as a whole, have the necessary knowledge and expertise to

discharge their duties; and

(e) the records of the

partnership, including the records referred to in sub-paragraph (c), are

kept in Jersey.

(3) In

paragraph (2), unless guidance to the contrary is issued by the Comptroller

under paragraph (4), “governing body”, in relation to a partnership, means –

(a) the person or group of persons

responsible for making the partnership’s strategic and management decisions;

but

(b) if that person or group

is not able to be identified, all of the partners in the partnership.

(4) The Comptroller –

(a) may issue guidance on how

the economic substance test may be met;

(b) may issue guidance on the

meaning of any expression used in this Article for the purpose of the economic

substance test; and

(c) must publish any guidance

issued (and any amendments to the guidance) in a manner which the Comptroller

considers will bring it to the attention of those most likely to be affected by

it.

(5) In determining whether the economic

substance test has been met, or the meaning of an expression used in this

Article, a person must have regard to any guidance issued under paragraph (2)

or under Article 5(4) of the Taxation

(Companies – Economic Substance) (Jersey) Law 2019.

9 Assessment of whether

economic substance test is met

(1) The Comptroller may determine that a

resident partnership has not met the economic substance test for a financial

period –

(a) up to 6 years after the

end of the financial period; or

(b) if the Comptroller is not

able to make a determination within the 6‑year period by reason of any

deliberate misrepresentation or negligent or fraudulent action by the resident partnership

or by any other person, at any time.

(2) The Comptroller must determine that a high

risk IP partnership has not met the economic substance test for a financial

period unless the partnership provides sufficient

information to satisfy the Comptroller that the test is met.

10 Penalties for failing to

meet economic substance test

(1) A resident partnership is liable to a fine

not exceeding £10,000 if –

(a) the Comptroller

determines that the partnership has failed to meet the economic substance test

for a financial period; and

(b) the partnership has not,

during the previous financial period, been notified of a determination that the

partnership has not met the economic substance test.

(2) A resident partnership is liable to a fine

not exceeding the amount calculated under paragraph (3) if –

(a) the Comptroller

determines that the partnership has failed to meet the economic substance test

for a financial period; and

(b) during the previous

financial period, the partnership has been notified of a determination that the

partnership has not met the economic substance test.

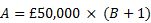

(3) The maximum amount of the penalty a

partnership is liable to under paragraph (3) is –

where –

A is the maximum amount

of the penalty; and

B is the number previous

consecutive financial periods, immediately before the financial period the

penalty relates to, in which the Comptroller has notified the partnership of

its failure to meet the economic substance test.

(4) If the Comptroller determines that a

partnership has failed to meet the economic substance test for a financial

period, the Comptroller must determine the amount of the penalty and must

notify the partnership –

(a) that the Comptroller has

determined that the partnership does not meet the economic substance test for

the financial period;

(b) of the reasons for the

determination;

(c) of the amount of the

penalty imposed on the partnership;

(d) of the date from which

penalty is due, which must not be less than 30 days after the Comptroller

issues the notice;

(e) of the action the

Comptroller considers the partnership should take to meet the economic

substance test for future financial periods; and

(f) of the partnership’s

right of appeal under Article 16.

(5) If the Comptroller determines that a

partnership is liable to a fine under paragraph (2), –

(a) the Comptroller may provide

the Minister with a report stating that the partnership has failed to meet the

economic substance test, along with any other information that the Comptroller

considers relevant; and

(b) the Comptroller must, in

the notice issued under paragraph (4), notify the partnership that the

Comptroller may make a report to the Minister.

(6) If the Minister receives a report in

relation to a partnership under paragraph (5), the Minister may –

(a) apply to the Court for an

order under Regulation 19 of the Incorporated

Limited Partnerships (Jersey) Regulations 2011, if

the partnership is an incorporated limited partnership;

(b) apply to the Court for an

order under Article 23A of the Limited

Liability Partnerships (Jersey) Law 2017, if

the partnership is a limited liability partnership; or

(c) provide the report to the

Jersey Financial Services Commission (established by the Financial

Services Commission (Jersey) Law 1998),

if the partnership is not an incorporated limited partnership or a limited

liability partnership.

PART 3

Requirement to provide information

11 Requirement to provide

information

(1) A resident partnership must provide any

information reasonably required by the Comptroller in order to assist the

Comptroller in making a determination under Article 9.

(2) The Comptroller may serve notice on any

person or partnership requiring the person or partnership to provide, within

the period specified in the notice and at such place as is specified in the

notice, such documents and information as the Comptroller may reasonably

require for the purpose of facilitating the Comptroller’s exercise of functions

under this Law.

(3) A person or partnership served with a

notice under paragraph (2) must provide the information in the manner and

within the period specified in the notice.

12 Penalties for failure to

provide information or for providing inaccurate information

(1) A person or partnership who fails to comply

with a requirement to provide information or documents under Article 11 is

liable to a penalty not exceeding £3,000.

(2) A person or partnership who is required to

provide information under Article 11 is liable to a penalty not exceeding

£3,000 if the person or partnership provides inaccurate information and –

(a) knows of the inaccuracy

at the time the information is provided but does not inform the Comptroller at

that time; or

(b) discovers the inaccuracy

after the information is provided and fails to take reasonable steps to inform

the Comptroller.

(3) A person or partnership is not liable to a

penalty under this Article if the person or partnership satisfies the

Comptroller that the person or partnership has a reasonable excuse.

(4) If a person or partnership is liable to a

penalty, the Comptroller must determine the amount of the penalty and must

notify the person or partnership of –

(a) the reasons for imposing

the penalty;

(b) the amount of the penalty

imposed;

(c) the date from which the

penalty is due, which must not be less than 30 days after the Comptroller

issues the notice; and

(d) the right of appeal under

Article 16.

PART 4

Comptroller’s duties and powers

13 Exchange of information

to competent authorities

(1) This Article applies if the Comptroller

determines that a resident partnership has not met the economic substance test

for a financial period.

(2) The Comptroller must provide any

information provided under Article 11 relating to the partnership for the

financial period to the competent authority of the countries or territories in

which the following people or partnerships are tax residents –

(a) a controlling partner of

the partnership;

(b) the ultimate holding body

of the controlling partner;

(c) the ultimate beneficial

owner of the partnership.

(3) The Comptroller must provide any

information provided under Article 11 relating to a high risk IP partnership

(regardless of whether the partnership has met the economic substance test) to

the competent authority of the countries or territories in which the following

people or partnerships are tax residents –

(a) a controlling partner of

the partnership;

(b) the ultimate holding body

of the controlling partner;

(c) the ultimate beneficial

owner of the partnership.

(4) This Article applies –

(a) only to the extent to

which the provision of information is permitted under –

(i) a bilateral agreement

made between Jersey and a country or territory, or

(ii) the OECD and Council of

Europe (2011), Multilateral Convention on Mutual Administrative Assistance in

Tax Matters: Amended by the 2010 Protocol; but

(b) despite any obligation as

to confidentiality or other restriction on the disclosure of information

imposed by statute, contract or otherwise.

(5) In this Article, –

“competent authority”, in

respect of a country or territory other than Jersey, means the authority

designated in or for the purposes of an approved agreement or an approved

obligation within the meaning of the Taxation

(Implementation) (Jersey) Law 2004;

“controlling partner”, in

relation to a partnership, means a person or partnership that is entitled to 50%

or more of the income or property of that partnership.

14 Power to enter business premises and

examine business documents

(1) An

authorised person may, for the purpose of investigating any issue relating to

compliance with a provision of this Law, examine and take copies of any

business document that is located on business premises.

(2) In

order to exercise that power, an authorised person may –

(a) enter business premises

at any reasonable hour; and

(b) by notice require any

person to produce any specified business document at the business premises

where the document is located.

(3) In

this Article, –

“business document” means any document –

(a) that relates to the

carrying on of a business, trade, profession or vocation by a person or

partnership; and

(b) that forms part of any

record under any enactment;

“business premises” means

premises used in connection with the carrying on of a business, trade,

profession or vocation.

15 Offences and penalties for obstructing

authorised person or altering business documents

(1) A

person who, without reasonable excuse, obstructs an authorised person

exercising a power under Article 14 –

(a) commits an offence; and

(b) is liable to imprisonment

for a term not exceeding 6 months and to a fine.

(2) A

person who, without reasonable excuse, fails to provide such reasonable

assistance as an authorised person may require when exercising a power under Article 14 –

(a) commits an offence; and

(b) is liable to imprisonment

for a term not exceeding 6 months and to a fine.

(3) A

person who intentionally alters, suppresses or destroys any document that has

been specified in a notice under Article 11(2) –

(a) commits an offence; and

(b) is liable to imprisonment

for a term of not exceeding 2 years and to a fine.

PART 5

appeals,

enforcement and other matters

16 Right of appeal

(1) A

person may appeal to the Commissioners (as defined in Article 3(1) of the

1961 Law) against a decision made by the Comptroller under this Law by giving

notice in writing to the Comptroller within 30 days after receiving

notification of the decision.

(2) Part

6 of the 1961 Law applies, with the necessary modifications, to an appeal

under paragraph (1) as if it were an appeal against an assessment made

under that Law.

17 Enforcement of penalties

(1) A

penalty imposed under this Law must be paid before the end of the period of 30 days

beginning with –

(a) the date stated as the

date from which the penalty is due in the notification of the penalty; or

(b) if the decision to impose

the penalty or the determination of the amount of the penalty is appealed, the

date on which the appeal is finally determined or withdrawn.

(2) A

penalty under this Law may be enforced as if it were income tax charged in an

assessment and due and payable.

18 Disclosure of information and confidentiality

(1) A person must not disclose information

obtained under this Law unless –

(a) the disclosure is

expressly required by this Law;

(b) every person to whom the

information relates consents to the disclosure;

(c) the disclosure is made

for the purpose of any civil proceedings (whether or not in Jersey), including

any investigation as to whether to institute any civil proceedings, relating to

a matter in respect of which the Comptroller has functions under a Law;

(d) the disclosure is made

for the purpose of investigating whether or not an offence has been committed

(whether or not in Jersey), or for the institution of, or otherwise for the

purpose of, any criminal proceedings (whether or not in Jersey);

(e) the disclosure –

(i) is of statistical

information only,

(ii) is made to an

administration of the States for which a Minister has responsibility, and

(iii) is made for the purpose

of assisting in the development of public policy; or

(f) the

disclosure is of statistical information only and is made to an international

body for the purpose of monitoring the implementation of this Law.

(2) A person who discloses information to the

Comptroller in accordance with this Law does not breach –

(a) any obligation of

confidentiality in relation to the information disclosed; or

(b) any other restriction on

the access to or disclosure of the information accessed.

19 Regulations

(1) The

States may by Regulations amend –

(a) the definition of any

term defined in this Law; and

(b) a penalty that may be

imposed under this Law.

(2) Regulations

under this Article may include any consequential, incidental, supplementary,

transitional and savings provisions as the States think necessary or expedient,

including provisions which amend any other enactment.

20 Transitional arrangements

Schedule 1 gives effect

to transitional arrangements.

21 [2]

22 Citation and commencement

This Law may be cited as

the Taxation (Partnerships – Economic Substance) (Jersey) Law 2021 and comes

into force 7 days after it is registered.