Public Employees (Pension

Scheme) (Funding and Valuation) (Jersey) Regulations 2015

PART 1

interpretation

1 Interpretation[1]

In these Regulations, unless

the context indicates otherwise –

“1967 Scheme”

has the meaning given in Article 1(1) of the Law;

“1967 Regulations”

means the Public Employees (Contributory Retirement Scheme) (Jersey)

Regulations 1967;

“1967 Scheme

benefits” means retirement benefits accrued under the 1967 Scheme;

“1967 Scheme

employer” means an employer –

(a) who,

before 1st January 2016, was admitted to the 1967 Scheme under

repealed Regulation 9 of the General Regulations;

(b) who,

before 1st January 2016, was treated as if admitted to the 1967 Scheme

under any enactment which provided for that employer to become an employer for

the purposes of that scheme in respect of members of that scheme whose

employment with the States Employment Board was transferred to that employer; or

(c) who

is treated as if admitted to the 1967 Scheme under Regulation 7

of, and paragraph 2(5) of Schedule 1 to, the Membership and Benefits

Regulations;

“1967 Scheme

Regulations” has the meaning given in Article 1(1) of the Law;

“1992 Regulations”

means the Public Employees (Contributory Retirement Scheme) (Former Hospital

Scheme) (Jersey) Regulations 1992;

“accrual rate” shall

be construed in accordance with Regulation 7;

“active member” has

the same meaning as in Regulation 1 of the Membership and Benefits

Regulations;

“Actuary” means a

person appointed in accordance with Regulation 10 of the Administration

Regulations, to give actuarial advice in respect of the fund;

“Administration

Regulations” means the Public Employees (Pension Scheme) (Administration) (Jersey)

Regulations 2015;

“Administrator”

shall be construed in accordance with Regulation 19 of the Administration

Regulations;

“admitted employer”

means an employer other than the States Employment Board –

(a) admitted

to the Scheme under –

(i) Regulation 7

of, and paragraph 2(1) of Schedule 1 to, the Membership and Benefits

Regulations,

(ii) Regulation 16(1)

of the Transitional Regulations, or

(iii) Article 10(5)

of the Law;

(b) treated

as if admitted to the Scheme under any enactment which provides for that

employer to become an employer for the purposes of the Scheme in respect of

members of the Scheme whose employment with the States Employment Board is

transferred to that employer; or

(c) who

is a 1967 Scheme Employer;

“AIRPI” means the

All

Items Retail Prices Index Rate for Jersey as recorded over the year to

September of the year preceding the annual pension increase;

“annual pension

increase” shall be construed in accordance with Regulation 8;

“assets” means

anything tangible or intangible that is owned or controlled to produce an

economic value (including investments, debts or cash);

“category A

member” and “category B member” has the meaning given in

Regulation 1 of the Existing Members Regulations and Regulation 1 of

the New Members Regulations;

“category C member”

has the meaning given in Regulation 1 of the New Members Regulations;

“cohabiting

partner” has the meaning given in Regulation 3 of the Membership and

Benefits Regulations;

“Committee” shall

be construed in accordance with Article 4 of the Law and Regulation 2

of the Administration Regulations;

“continuing members of

the 1967 Scheme” means contributing members of that scheme construed

in accordance with Regulation 3(2)(b) of the Transitional Regulations;

“contributing members

of the 1967 Scheme” means a –

(a) contributory

member;

(b) category A

member, category B member, or category C member;

(c) “member”

within the meaning of Regulation 1 of the Existing Members Regulations and

Regulation 1 of the New Members Regulations, who is not a category A,

category B or category C member; and

(d) “member”

within the meaning of Regulation 1 of the 1992 Regulations;

“contributory member”

has the meaning given in Regulation 4 of the 1967 Regulations;

“deferred or pensioner

members of the Scheme” shall be construed in accordance with Regulations 11

and 12 respectively of the Membership and Benefits Regulations;

“deferred or pensioner members of the 1967 Scheme” means –

(a) in

the case of a deferred member of that scheme, a person who –

(i) has ceased to

make contributions under the 1967 Scheme Regulations, and

(ii) is

not in receipt of retirement benefits under those Regulations;

(b) in

the case of a pensioner member of that scheme, a person who is in receipt of retirement

benefits under the 1967 Scheme Regulations (regardless of whether or

not he or she is an active member of the Scheme);

“employer” means an

admitted employer or the States Employment Board;

“Existing Members

Regulations” means the Public Employees (Contributory Retirement Scheme) (Existing Members)

(Jersey) Regulations 1989;

“funding level”

shall be construed in accordance with Regulation 17;

“funding strategy

statement” has the meaning given in Regulation 2;

“General Regulations”

means the Public Employees (Contributory Retirement Scheme) (General) (Jersey)

Regulations 1989;

“Law” means the Public Employees (Pensions) (Jersey) Law 2014;

“liabilities”

means the costs of future benefits and other outgoings payable under the respective

schemes, accrued as at the valuation date;

“members of the

respective schemes” means active members of the Scheme and continuing

members of the 1967 Scheme;

“Membership and

Benefits Regulations” means the Public Employees (Pension Scheme) (Membership and Benefits) (Jersey)

Regulations 2015;

“Minister” means

the Chief Minister;

“New Members

Regulations” means the Public Employees (Contributory Retirement Scheme) (New Members)

(Jersey) Regulations 1989;

“ordinary member”

means an active member of the Scheme who is not a uniformed member;

“pensionable earnings”

has the same meaning as in Regulation 4 of the Membership and Benefits

Regulations;

“pension record”

is a record established and maintained in accordance with Regulation 20 of

the Membership and Benefits Regulations;

“pensionable service”

in relation to the Scheme, means a period of Scheme employment computed in

years and complete days;

“pre-1988 liability”

shall be construed in accordance with Schedule 5;

“prudent assumptions”

means a set of actuarial assumptions that, when taken together, are more likely

to overestimate than underestimate the amount of money actually required to

meet the costs of funding the liabilities of the Scheme;

“rates and adjustments

certificate” means a certificate produced in accordance with

Regulation 3;

“relevant trade unions”

means any organization within the meaning of Article 3 of the Employment Relations (Jersey) Law 2007 whose membership consists (whether wholly or mainly) of members of

the respective schemes;

“repealed

Regulation 9 of the General Regulations” means Regulation 9 of

the General Regulations as it was in force immediately prior to its repeal by

the Transitional Regulations;

“respective schemes”

has the meaning given in Article 1(1) of the Law, and “schemes”

shall be construed accordingly;

“revaluation rate”

shall be construed in accordance with Regulation 9;

“Scheme” means

the Public Employees Pension Scheme referred to in Article 2(1) of the Law;

“Scheme employment”

means employment by virtue of which a person is entitled to be a member of the

Scheme;

“scheme year”

means a period of 12 months beginning on 1st January and ending

31st December;

“transition members”

means contributing members of the 1967 Scheme who become members of

the Scheme in accordance with Regulation 2 or 3(2)(a) or (c) of the Transitional

Regulations;

“Transitional

Regulations” means the Public Employees (Pension Scheme) (Transitional Provisions, Savings

and Consequential Amendments) (Jersey) Regulations 2015;

“Treasurer” means

the Treasurer of the States;

“uniformed member”

in relation to the Scheme has the same meaning as in Regulation 1 of the Membership

and Benefits Regulations;

“valuation” has

the meaning given in Regulation 3(1);

“valuation date” means the date as at which the

Actuary carries out a valuation of the fund in accordance with

Regulation 3(1) or 5(1);

“valuation of the fund” means an actuarial valuation of the

fund by reference to the assets and liabilities of the respective schemes.

part 2

funding strategy and valuations

2 Funding

strategy statement

(1) The

Committee shall instruct the Actuary to prepare a written statement setting out

the funding strategy for the respective schemes (the “funding strategy

statement”).

(2) The

funding strategy statement shall –

(a) following

consultation with the Treasurer, be agreed by the Committee and the Minister

for Treasury and Resources, and published by the Committee by no later than

31st December 2017;

(b) be

kept under review by the Committee and –

(i) following

a material change to any of the matters contained in the statement, the Actuary

shall make such revisions as are appropriate and consulted upon and agreed in

accordance with sub-paragraph (a),

(ii) if

revisions are made, the Committee shall publish the statement as revised;

(c) set

out the following matters –

(i) subject

to paragraph (3), the methodology for the allocation of employer and

member contributions made under the respective schemes, towards the costs of

funding benefits under the respective schemes over a specified period,

(ii) the

methodology for maintaining, within the caps specified under Regulation 16,

the sharing of the respective costs of employer and member contributions on an

expected ratio of 2:1 with “2” being the employer proportion of

contributions and “1” being the member proportion of contributions,

(iii) the

methodology for the allocation of administration, investment management and

other costs attributable to the funding of benefits under the respective

schemes,

(iv) the

overarching principles for the setting of assumptions to be applied to the

actuarial valuation of the fund, which shall include the use of prudent

assumptions in relation to the costs of funding benefits under the Scheme,

(v) the

overarching principles for the setting of assumptions for the purposes of

calculating –

(A) the

value of retirement benefits transferred under Regulations 22 or 23 of the Administration Regulations,

(B) amounts

payable in respect of additional voluntary contributions required under Regulation 15

of the Membership and Benefits Regulations or equivalent provisions under the 1967 Scheme

Regulations,

(C) the

amount by which retirement benefits are actuarially reduced where those

benefits are paid early under Regulations 29, 30 or 32 of the Membership and Benefits Regulations, or equivalent provisions under the 1967 Scheme

Regulations,

(vi) the

degree of prudence to be applied when setting key financial assumptions for the

purposes of actuarial valuations,

(vii) the

methodology for adjusting –

(A) the

annual pension increase rates and contribution rates for the respective

schemes, and

(B) the

future accrual rate and revaluation rate for the Scheme,

(viii) the

identification of risks to the solvency of the fund and mitigation of such

risks,

(ix) the

process for implementing any adjustments to any of the rates specified in the rates and adjustments

certificate,

(x) the

methodology for accounting for the costs of funding benefits attributable to –

(A) transfer

payments out of the fund under Regulation 22 of the Administration Regulations, and

(B) transfer

payments credited to the fund under Regulation 23 of those Regulations.

(3) This

paragraph sets out what matters the Actuary must include within the methodology

for the allocation of member and employer contributions referred to in

paragraph (2)(c)(i), as follows –

(a) the

proportion of employer and member contributions received under the respective

schemes that shall be required to fund –

(i) the

costs of applying the interim contribution rates set out in paragraph 5(3)

and (4) of Schedule 1 in respect of the 1967 Scheme,

(ii) the

costs of applying the transitional contribution rates set out in Schedule 3

in respect of the continuing members of the 1967 Scheme,

(iii) the

costs of 1967 Scheme benefits accrued after 1st

January 2019 in

respect of continuing members of the 1967 Scheme, and

(iv) the

costs of providing survivor benefits to a cohabiting partner under

Regulation 11 of the Transitional Regulations; and

(b) the

proportion of employer and member contributions received under the respective

schemes that shall, in the sequence set out in this sub-paragraph, be

required –

(i) firstly,

to fund 1967 Scheme benefits accrued (without any increase or

reduction to those benefits) in respect of –

(A) continuing

members of the 1967 Scheme,

(B) contributing,

deferred or pensioner members of the 1967 Scheme, and

(C) contributing

members of the 1967 Scheme who become active members of the Scheme under Regulation 2, 3(2)(a) or (c) or 4 of the Transitional

Regulations,

(ii) secondly,

after clause (i) is achieved, to fund –

(A) the accrued

retirement benefits under the Scheme (as increased by the annual pension

increase at a minimum rate of 50% of AIRPI) of deferred or pensioner members of

the Scheme, and

(B) the

accrued retirement benefits under the Scheme (as revalued by a minimum rate of

50% of (AIRPI + 1%)) of active members of the Scheme, and as

subsequently increased by the annual pension increase at a minimum rate of 50%

of AIRPI, when those members become deferred or pensioner members of the

Scheme, and

(iii) thirdly,

after clauses (i) and (ii) are achieved, to fund the future accrual of

benefits under the respective schemes.[2]

3 Actuarial

valuations

(1) The

Committee shall instruct the Actuary to prepare –

(a) a

valuation of the fund as at 31st December 2016, 31st December 2018

and 31st December 2021, and thereafter at intervals of not more than 3 years;

(b) a

report in respect of the valuation; and

(c) a

rates and adjustments certificate, and

those

documents shall collectively be referred to as the “valuation”.

(2) In

preparing each of the documents specified in paragraph (1), the Actuary

must have regard to –

(a) the

existing and prospective liabilities of the fund in relation to the respective

schemes; and

(b) the

funding strategy statement (as revised from time to time).

(3) Subject

to Regulation 4(3) and (5), the valuation must be presented to the

Minister by the Committee before the expiry of 15 months after the

valuation date, and the Minister shall lay a copy the valuation before the

States as soon as practicable thereafter.

(4) A

report under paragraph (1)(b) shall –

(a) separately

identify the assets and liabilities of the respective schemes;

(b) contain

an assessment of whether any change in the fund’s funding level is due to

long-term trends of a demographic, investment or other nature;

(c) contain

an assessment of whether the accrual of future benefits under the respective

schemes is affordable within the contribution cost caps referred to in Regulation 16(1).

(5) A

rates and adjustments certificate under paragraph (1)(c) is a certificate which

specifies any adjustments to –

(a) the

accrual rate for the Scheme;

(b) the

rates for the annual pension increase for the respective schemes;

(c) the

employer and member contribution rates (expressed as a percentage of

pensionable earnings) for the respective schemes; and

(d) the

revaluation rate for the Scheme,

without

the need to amend these Regulations or the 1967 Scheme

Regulations (as the case may be).

(6) Subject

to Regulation 17 and 18 (if applicable), the Actuary shall, when

preparing the rates and adjustments certificate, specify any adjustments –

(a) to

the accrual rate subject to Regulations 7(2) and 12(3);

(b) to

the annual pension increase rates subject to the minimum and maximum

percentages of AIRPI specified in Regulation 8 and Regulation 12(3);

(c) to

the employer and member contribution rates subject to Regulations 11, 12(4),

13(2), 14(2) and 15(2);

(d) to

the revaluation rate subject to Regulations 9 and 12(3).

(7) The

contribution rates referred to in paragraph (5)(c) shall specify a primary

and secondary rate, where –

(a) the

primary rate of employer and member contributions is the amount required to

fund the cost of future accrual of benefits under the respective schemes which,

according to the methodology set out in the funding strategy statement, should

be paid to the fund, expressed as a percentage of pensionable earnings; and

(b) the

secondary rate of employer and member contributions is the percentage of pensionable

pay by which, according to the methodology set out in the funding strategy

statement, contributions at the primary rate should be increased or reduced (as

the case may be) to fund the costs of –

(i) 1967 Scheme benefits (without any reduction

to those benefits) accrued in respect of –

(A) deferred

or pensioner members of the 1967 Scheme,

(B) continuing

members of the 1967 Scheme,

(C) contributing

members of the 1967 Scheme up to 1st January

2019,

and

(D) contributing

members of the 1967 Scheme who become active members of the Scheme under Regulation 2, 3(2)(a) or (c) or 4 of the Transitional

Regulations,

(ii) the

accrued retirement benefits of deferred or pensioner members of the Scheme, as

increased by the annual pension increase at a minimum rate of 50% of AIRPI, and

(iii) the

accrued retirement benefits of active members of the Scheme –

(A) as

revalued by a minimum rate of 50% of (AIRPI + 1%), and

(B) as

subsequently increased by the annual pension increase at a minimum rate of 50%

of AIRPI, when those members become deferred or pensioner members of the

Scheme.[3]

4 Agreement

as to the setting of assumptions for actuarial valuations

(1) In

the course of preparing a valuation under Regulation 3, the Actuary shall –

(a) consult

with the Committee, the Minister for Treasury and Resources and the Treasurer;

and

(b) determine,

having regard to the funding strategy statement, an appropriate set of

assumptions to be applied in respect of the valuation.

(2) In

relation to the costs of funding the Scheme the Actuary shall, following the

consultation referred to in paragraph (1)(a), determine the prudent

assumptions to be applied in respect of the valuation but must secure the

agreement of –

(a) the

Committee; and

(b) the

Minister for Treasury and Resources,

before

applying those assumptions.

(3) If

upon the expiry of 18 months from the valuation date no agreement is

secured under paragraph (2), the Minister shall request the President of

the Institute and Faculty of Actuaries (the “Institute”) to nominate

a fellow of the Institute, to determine the prudent assumptions that shall apply

in default of any agreement.

(4) In

relation to the costs of funding the 1967 Scheme the Actuary shall,

following the consultation referred to in paragraph (1)(a), determine the

assumptions to be applied in respect of the valuation and shall aim to reach agreement

with –

(a) the

Committee; and

(b) the

Minister for Treasury and Resources,

before

applying those assumptions.

(5) If

upon the expiry of 12 months from the valuation date no agreement is reached

under paragraph (4), the Actuary’s determination shall apply in

default of any agreement.

5 Actuarial

valuations at the request of the Minister

(1) Notwithstanding

Regulation 3, the Minister may require the Committee to instruct the

Actuary to undertake a valuation of the fund as at any date.

(2) Where

paragraph (1) applies, the provisions of Regulations 3 and 4

(including any adjustment to the rates specified in the rates and adjustments

certificate) shall operate as if the valuation had been carried out under Regulation 3.

6 Implementation

of rates and adjustments certificate

The

Administrator shall by 1st January not later than the 3rd year following

the valuation date, apply all the rates specified in the rates and

adjustments certificate for that valuation.

part 3

rates

7 Scheme

accrual rate

(1) “accrual rate” means the rate, expressed as a fraction

of pensionable earnings, at which pension benefits build up per £1.00 of

pensionable earnings paid in each scheme year for each year of pensionable

service.

(2) Subject to Regulation 12 and paragraph 1 of Schedule 1, the accrual rate shall be such rate as

is specified in the rates and adjustments certificate and the Actuary may at

any valuation adjust the accrual rate subject to –

(a) the

methodology as referred to in Regulation 2(2)(c)(vii) and 2(3)(b)(i)

and(ii);

(b) following

the process as referred to in Regulation 2(2)(c)(ix); and

(c) Regulation 16,

provided

that adjusted rate is not greater than 1/66th.

8 Annual

increases in pension

(1) Subject

to Regulation 12 and paragraph 2 of Schedule 1, all retirement

benefits in payment and all deferred retirement benefits under the respective

schemes shall be increased on 1st January each year by the rate referred to in paragraph (2)

(the “annual pension increase”).

(2) The

annual pension increase to be applied shall be a rate expressed as a percentage

of AIRPI specified in the rates and adjustments certificate, subject to the

minimum and maximum percentages of AIRPI specified in paragraphs (3) and

(4).

(3) In

respect of the Scheme, the percentage of AIRPI to be specified in the rates and

adjustments certificate for the purposes of applying the annual pension

increase, shall be a minimum of 50% of AIRPI up to and including a maximum of

100% of AIRPI.

(4) In respect of the 1967 Scheme –

(a) the percentage of AIRPI

to be specified in the rates and adjustments certificate for the purposes of

applying the annual pension increase, shall be a minimum of 0% of AIRPI up to

and including a maximum of 100% of AIRPI;

(b) paragraph (5) applies if, during the year

preceding the year in which the annual pension increase is applied –

(i) retirement benefits come into payment,

or

(ii) entitlement to deferred retirement

benefits (including any deferred lump sum under the 1992 Regulations)

arises.[4]

(5) Retirement benefits referred to in paragraph

(4)(b) are to be increased only by 1/365 of the full annual pension increase

rate for each day of payment or entitlement.[5]

9 Revaluation rate

(1) This

Regulation applies to the revaluation of retirement benefits under the Scheme.

(2) By

no later than 31st December of every scheme year, the opening balance of an

active member’s pension record for that scheme year shall be revalued by

the rate referred to in paragraph (3) (the “revaluation

rate”).

(3) Subject

to Regulation 12 and paragraph 3 of Schedule 1, the revaluation

rate to be applied shall be (AIRPI + 1%) multiplied by a percentage rate of between

50% and 100% as shall be determined by the Actuary and specified in the rates

and adjustments certificate.

(4) In

paragraph (2), “opening balance” means the amount of benefits

accrued in the active member’s pension record as at the beginning of the

scheme year.

10 Negative

AIRPI

(1) This

Regulation applies where AIRPI is recorded at less than 0%.

(2) Where

this Regulation applies, for the purposes of Regulations 8 and 9 the

AIRPI to be applied shall be taken to be 0%.

11 Employer

and member contribution rates

(1) For

the purposes of this Regulation –

(a) “uniformed

members of the respective schemes” in relation to –

(i) an

active member of the Scheme, means a uniformed member, and

(ii) a

continuing member of the 1967 Scheme, means –

(A) a

category A member and category B member within the meaning of Regulation 1

of the Existing Members Regulations or Regulation 1 of the New Members

Regulations,

(B) a category C

member within the meaning of Regulation 1 of the New Members Regulations, or

(C) a

contributory member within the meaning of Regulation 4

of the 1967 Regulations, in respect of whom Regulation 17, 18, 19, 20

or 20A of those Regulations applies;

(b) “ordinary

members of the respective schemes” in relation to –

(i) an

active member of the Scheme, means an ordinary member, and

(ii) a

continuing member of the 1967 Scheme, means –

(A) a member within the meaning of Regulation 1 of the Existing

Members Regulations or Regulation 1 of the New Members Regulations, who is

not a category A, category B or category C member,

(B) a

member within the meaning of Regulation 1 of the 1992 Regulations,

or

(C) a contributory member

within the meaning of Regulation 4 of the 1967 Regulations, in

respect of whom Regulation 17, 18, 19, 20 or 20A of those

Regulations does not apply; and

(c) for

the purposes of the calculation under the formula set out in paragraph (3)(d),

the reference to pensionable earnings shall be taken to be a reference to

pensionable earnings paid over the scheme year to the valuation date.

(2) Subject

to –

(a) Regulation 12

and paragraphs 4 and 5 of Schedule 1;

(b) Regulation 13

and Schedule 2;

(c) Regulation 14

and Schedule 3; and

(d) Regulation 15

and Schedule 4,

employers

and members of the respective schemes must pay contributions of such an amount

as is specified in the rates and adjustments certificate, expressed as a rate

equivalent to a percentage of pensionable earnings of all members of the

respective schemes.

(3) For

the purposes of paragraph (2) the rates and adjustments certificate must

specify –

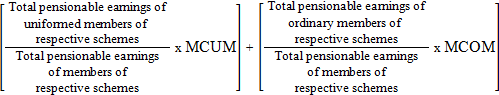

(a) the

employer contribution rate in respect of all members of the respective schemes;

(b) the

member contribution rate in respect of uniformed members of the respective

schemes (“MCUM”);

(c) the

member contribution rate in respect of ordinary members of the respective

schemes (“MCOM”); and

(d) the

member aggregated contribution rate which shall be calculated in accordance

with the following formula –

=

member aggregated contribution rate.

(4) For

the purposes of the employer contribution cost cap under Regulation 16(1)(a),

the employer contribution rate specified in the rates and adjustments certificate

must not exceed 16.5% of pensionable earnings of all members of the

respective schemes.

(5) Subject

to paragraph (6), for the purposes of the member contribution cost cap

under Regulation 16(1)(b), the member aggregated contribution rate

specified in the rates and adjustments certificate must not exceed 8.25% of

pensionable earnings of all members of the respective schemes.

(6) Paragraph (5)

shall not apply where the member contribution cost cap is increased under Regulation 16(4),

but in the event that it is so increased, the member aggregated contribution

rate to be specified in the rates and adjustments certificate must not exceed

the member contribution cost cap as so increased.

(7) An

employer shall pay to the Administrator the relevant amount of employer

contribution according to –

(a) the

employer contribution rate specified in the rates and adjustments certificate;

(b) the

interim contribution rates specified in paragraphs 4(3) and 5(3) of Schedule 1;

or

(c) the

transitional contribution rates specified in Schedule 4,

by

no later than the end of the month following the month in which the

contribution falls due.

(8) An

employer shall pay to the Administrator the relevant amount of member

contribution deducted from members’ pensionable earnings according to –

(a) the

MCUM or MCOM rate (as the case may be) specified in the rates and adjustments

certificate;

(b) the

interim contribution rates specified in paragraph 4(4) or (5)

and 5(4) of Schedule 1; or

(c) the

transitional contribution rates specified in Schedules 2 and 3,

by

no later than the end of the month following the month in which the

contribution is deducted.

12 Interim rates

(1) Schedule 1 sets

out –

(a) the

annual pension increase rate in respect of retirement benefits under the 1967 Scheme;

(b) the

annual pension increase rate in respect of retirement benefits under the

Scheme;

(c) in

respect of the Scheme –

(i) the

accrual rate, and

(ii) the

revaluation rate; and

(d) the

employer and member contribution rates under the respective schemes,

which shall apply from 1st January 2016 until

the dates specified in paragraph (2).[6]

(2) In the case of –

(a) the

annual pension increase rate referred to in paragraph (1)(a), that rate

shall apply until 31st December 2018;

(b) the

rates referred to in paragraphs (1)(b) and (c), those rates shall

apply until 31st December 2020; and

(c) the

employer and member contribution rates referred to in paragraph (1)(d) –

(i) in

relation to the Scheme, those rates shall apply until 31st December 2023,

and

(ii) in

relation to the 1967 Scheme, those rates shall apply until 31st December 2018.

(3) In the case of the

accrual rate, the annual pension increase rate in respect of retirement

benefits under the Scheme and the revaluation rate, any

valuation occurring as at a date earlier than 31st December 2018

shall not affect those rates specified in Schedule 1, and Regulation 3(6)(a),

(b) or (d) and Regulation 17 shall not apply for the purposes of adjusting

the rates and adjustments certificate in respect of any such earlier valuation.

(4) In the case of the

employer and member contribution rates (in relation to the Scheme), any

valuation occurring as at a date earlier than 31st December 2021

shall not affect those rates specified in Schedule 1, and Regulations 3(6)(c)

and Regulations 17 and 18 (if applicable) shall not apply for the

purposes of adjusting the rates and adjustments certificate in respect of any

such earlier valuation.

13 Scheme member

transitional contribution rates

(1) Schedule 2 sets

out the contributions rates –

(a) payable

by transition members; and

(b) which

shall apply from 1st January 2019 until

31st December 2023.[7]

(2) Any valuation occurring

as at a date earlier than 31st December 2021 shall not affect the

rates specified in Schedule 2, and Regulations 3(6)(c), 17 and 18

(if applicable) shall not apply for the purposes of adjusting the rates and

adjustments certificate in respect of any such earlier valuation.

14 Continuing

members of the 1967 Scheme – transitional contribution

rates

(1) Schedule 3 sets

out the contribution rates payable by continuing members of the 1967 Scheme

which shall apply from 1st January 2019 until

31st December 2023.[8]

(2) Any valuation occurring

as at a date earlier than 31st December 2021 shall not affect the

rates specified in Schedule 3, and Regulations 3(6)(c), 17 and 18

(if applicable) shall not apply for the purposes of adjusting the rates and

adjustments certificate in respect of any such earlier valuation.

15 Employer

transitional contribution rates

(1) Schedule 4 sets

out the contribution rates payable by employers of –

(a) continuing

members of the 1967 Scheme; or

(b) transition

members,

which shall apply from the 1st January 2019 until

31st December 2023.[9]

(2) Any valuation occurring

as at a date earlier than 31st December 2021 shall not affect the

rates specified in Schedule 4, and Regulations 3(6)(c), 17 and 18

(if applicable) shall not apply for the purposes of adjusting the rates and

adjustments certificate in respect of any such earlier valuation.

part 4

Cost Caps and control of funding levels

16 Employer and

member contribution cost cap

(1) For the purposes of

Article 7 of the Law –

(a) The

employer contribution cost cap, under the respective schemes shall be set at 16.5%

of pensionable earnings of all members of the respective schemes as at the date

of the valuation except that –

(i) contributions

certified by the Actuary in respect of an admitted employer under paragraph 6(4)

of Schedule 1 to the Membership and Benefits Regulations,

(ii) a

termination contribution in respect of an admitted employer under

paragraph 8(5) of Schedule 1 to the Membership and Benefits

Regulations, or

(iii) contributions

in respect of the re-payment of the pre-1988 liability under Schedule 5,

shall be disregarded for the purposes of the cap;

(b) subject

to paragraphs (2), (3) and (4), the member contribution cost cap under the

respective schemes shall be set at 8.25% of pensionable earnings of all members

of the respective schemes as at the date of the valuation.

(2) This paragraph applies

if, following a valuation, the Actuary reports that the future accrual of

benefits under both of the respective schemes is unaffordable within the cost

caps specified under paragraph (1).

(3) Where paragraph (2)

applies, the Minister shall consult with relevant trade unions as to whether or

not members of the respective schemes would agree to an increase in the member

contribution cost cap specified under paragraph (1)(b), so as to avoid any

reduction in the future accrual of benefits under the Scheme.

(4) If at the conclusion of

a period of 3 months –

(a) there

is agreement to an increase in the member contribution cost cap specified under

paragraph (1)(b), the Actuary shall, subject to the requirement in Regulation 11(6),

determine the adjusted member aggregated contribution rate to be specified in

the rates and adjustments certificate;

(b) there

is no agreement to an increase referred to in sub-paragraph (a), the

Actuary shall determine the adjusted reduced accrual rate for the Scheme to be

specified in the rates and adjustments certificate.

17 Funding levels

(1) For the purposes of

this Regulation and Regulation 18 –

(a) “effective

valuation date” refers to a valuation of the fund carried out as at any

valuation date.

(b) “liabilities”

means the benefits payable under the respective schemes calculated according to –

(i) the assumptions

set by reference to the funding strategy statement, and

(ii) the

rates specified in the rates and adjustments certificate in respect of the

valuation of the fund carried out as at the previous valuation date;

(c) “previous

valuation date” means the valuation date immediately prior to the

effective valuation date;

(d) “full

funding level” means that as at the valuation date, the assets of the

respective schemes are 100% of the amount required to meet the liabilities of

the respective schemes;

(e) “maximum

funding level” means that as at the valuation date, the assets of the

respective schemes are 105% of the amount required to meet the liabilities of

the respective schemes;

(f) “minimum

funding level” means that as at the valuation date, the assets of the

respective schemes are 95% of the amount required to meet the liabilities of

the respective schemes.

(2) The Committee shall,

having regard to the formula set out in paragraph (3), aim to secure that

the assets of the respective schemes are at a sufficient level to fund the

benefits payable under the respective schemes.

(3) The Actuary shall at

every valuation of the fund certify in respect of the valuation date for that

valuation, the funding level of the respective schemes by reference to the

following formula –

|

value of assets of each scheme as at the

effective valuation date

|

x 100 = funding level (expressed as a

percentage).

|

|

value of liabilities of each scheme as at the

effective valuation date

|

(4) If

the Actuary certifies that either or both of the respective schemes are

operating within their maximum and minimum funding levels, and the Committee

determines either that –

(a) no

adjustments are required in respect of any of the rates specified in the rates

and adjustments certificate; or

(b) adjustments

are required in respect of some or all of the

rates,

the Committee shall

within 15 months of the valuation date, seek the Minister’s

agreement to that determination.

(5) If before the expiry of

15 months from the valuation date no agreement is given under paragraph (4),

the Actuary shall, subject to following the process as referred to in Regulation 2(2)(c)(ix),

determine what adjustments are required (if any) in respect of any of the rates

specified in the rates and adjustments certificate so as to restore either or

both of the respective schemes to their full funding level.

(6) If before the expiry of

15 months from the valuation date the Minister agrees with the

Committee’s determination under paragraph (4), the Actuary shall

prepare the rates and adjustments certificate with or without specifying any

adjustments, as the case may be.

(7) Subject to paragraph (9),

if the Actuary certifies that either or both the respective schemes are operating at or above their maximum funding level, or at or

below their minimum funding level, the Actuary shall, subject to following the

process as referred to in Regulation 2(2)(c)(ix) and Regulation 18

(if applicable), determine what adjustments are required (if any) in respect of

any of the rates specified in the rates and adjustments certificate so as to

restore either or both of the respective schemes to their full funding level.

(8) The Actuary shall, before

the expiry of 15 months after the valuation date, notify the Committee and

the Minister of the determination under paragraph (7).

(9) The Actuary shall not

determine any adjustments under paragraph (7) if the Committee and the Minister

have otherwise agreed that no adjustments are required to any of the rates

specified in the rates and adjustments certificate so as to restore either or

both of the respective schemes to their full funding level.

18 Transitional costs of funding benefits under the respective schemes

(1) This

Regulation applies where as at any valuation of the fund which occurs in the

period commencing with the valuation of the fund as at 31st December 2018

and ending on 31st December 2032, the Actuary certifies that either

or both the respective schemes are operating at or below their minimum funding

level.

(2) Where

paragraph (1) applies, the Actuary shall as at that valuation date,

calculate an adjusted value for the assets of the respective schemes by

including within that calculation the value of future employer and member

contributions to cover transitional costs equal to 0.8% of pensionable earnings

over the period to 31st December 2032, and having applied the formula

set out in paragraph (3) –

(a) certify

in respect of the valuation date for that valuation, the funding level for the

respective schemes as re-assessed under this Regulation; and

(b) determine

what adjustments are required (if any) in respect of any of the rates specified

in the rates and adjustments certificate so as to restore either or both of the

respective schemes to their full funding level.

(3) The

formula referred to in paragraph (2) is –

|

value of adjusted assets of each scheme

as at the effective

valuation date

|

x 100 = funding level (expressed

as a percentage).

|

|

value of liabilities of each scheme as at

the effective

valuation date

|

(4) The Actuary shall,

before the expiry of 15 months of the valuation date, notify the Committee

and the Minister of the determination under paragraph (2)(b).

(5) The

transitional costs referred to in paragraph (2) include the costs of –

(a) benefits

accruing in respect of continuing members of the 1967 Scheme which are in

excess of the costs of retirement benefits concurrently accruing in respect of active

members of the Scheme;

(b) applying

the transitional contribution rates set out in Schedules 2, 3 and 4;

(c) providing

survivor benefits to a cohabiting partner under Regulation 11 of the Transitional Regulations.[10]

Part 5

1967 Scheme assets

19 Ring-fencing

of 1967 Scheme assets

(1) The Committee shall ensure that the assets of

the 1967 Scheme which have accrued in respect of that scheme up to,

and including the day before 1st January 2019,

shall only be used for the purpose of funding the costs of benefits under that

scheme.

(2) For the purposes of

this Regulation, the assets of the 1967 Scheme shall include the

re-payment of the pre-1988 liability under Regulation 20 and Schedule 5.[11]

20 Re-payment

of the pre-1988 liability

Schedule 5 gives effect to the

re-payment of the pre-1988 liability in respect of the 1967 Scheme

and that re-payment shall be treated as an asset of that scheme for the

purposes of valuations under Regulation 3.

part 6

closing

21 Citation and

commencement

(1) These Regulations may

be cited as the Public Employees (Pension Scheme)

(Funding and Valuation) (Jersey) Regulations 2015.

(2) Regulations 13 to

15 and 18, and Schedules 2 to 4 shall come into force on 1st January 2019.[12]

SCHEDULE 1[13]

(Regulation 12)

Interim

rates

1 Accrual

rate until 31st December 2020

(1) The accrual rate

specified in sub-paragraph (2) shall apply from 1st

January 2016 until the scheme year ending 31st December 2020.

(2) The

accrual rate in respect of the Scheme shall be 1/66th of an active

member’s pensionable earnings paid in each scheme year.

(3) Subject

to sub-paragraph (4), following the valuation as

at 31st December 2018, an adjusted accrual rate (if any) specified in

the rates and adjustments certificate under Regulation 3(6)(a) shall, in

accordance with Regulation 6, be applied for the scheme year beginning on

1st January 2021.

(4) If

as a result of the valuation as at 31st December 2018, the accrual

rate specified in sub-paragraph (2) does not require an adjustment to be

specified in the rates and adjustments certificate under Regulation 3(6)(a),

that rate shall continue to have effect until such time as it is adjusted

following any subsequent valuation, and applied in accordance with Regulation 6.

2 Annual

increases in pension – rate for 1967 Scheme until 31st December 2018 and rate

for Scheme until 31st December 2020

(1) From

1st January 2016 until the scheme year ending 31st December 2018, the

annual pension increase rate in respect of retirement benefits under the 1967 Scheme

shall be 100% of AIRPI.

(2) Subject

to paragraph (3), following the valuation as at 31st December 2016,

an adjusted annual pension increase rate (if any) specified in the rates and

adjustments certificate under Regulation 3(6)(b) shall, in accordance with

Regulation 6, be applied for the scheme year beginning on 1st January 2019.

(3) If

as a result of the valuation as at 31st December 2016, the rate

specified in sub-paragraph (1) does not require an adjustment to be

specified in the rates and adjustments certificate under Regulation 3(6)(b),

that rate shall in relation to the 1967 Scheme, continue to have

effect on 1st January 2019 until such time as it is adjusted

following any subsequent valuation and applied in accordance with Regulation 6.

(4) From

1st January 2016 until the scheme year ending 31st December 2020, the

annual pension increase rate in respect of retirement benefits under the Scheme

shall be 100% of AIRPI.

(5) Subject

to sub-paragraph (6), following the valuation as at 31st December 2018,

an adjusted annual pension increase rate (if any) specified in the rates and

adjustments certificate under Regulation 3(6)(b) shall, in accordance with

Regulation 6, be applied for the scheme year beginning on 1st January 2021.

(6) If

as a result of the valuation as at 31st December 2018, the rate

specified in sub-paragraph (4) does not require an adjustment to be

specified in the rates and adjustments certificate under Regulation 3(6)(b),

that rate shall in relation to the Scheme, continue to have effect on 1st January 2021

until such time as it is adjusted following any subsequent valuation and

applied in accordance with Regulation 6.

3 Revaluation

rate until 31st December 2020

(1) The

revaluation rate specified in sub-paragraph (2) shall apply from 1st January 2016

until the scheme year ending 31st December 2020.

(2) The

revaluation rate in respect of the Scheme shall be (AIRPI + 1%) x

100%.

(3) Subject

to sub-paragraph (4), following the valuation as at 31st December 2018,

an adjusted rate (if any) specified in the rates and adjustments certificate

under Regulation 3(6)(d) shall, in accordance with Regulation 6, be

applied for the purposes of the revaluation of the scheme year ending on 31st December 2020.

(4) If

as a result of the valuation as at 31st December 2018, the rate

specified in sub-paragraph (2) does not require an adjustment to be

specified in the rates and adjustments certificate under Regulation 3(6)(d),

that rate shall continue to have effect for the purposes of the revaluation of

the scheme year ending on 31st December 2020 until such time as it is

adjusted following any subsequent valuation, and applied in accordance with Regulation 6.

4 Scheme –

employer and member contribution rates until 31st December 2023

(1) This

paragraph applies to –

(a) employers

of persons described in clauses (b) to (d);

(b) persons

(excluding transition members) who, on or after 1st January 2016, become active

members of the Scheme;

(c) deferred

or pensioner members of the Scheme (including such members who were formerly

transition members) who, before the rates specified in sub-paragraphs (4)

or (5) (as the case may be) cease to have effect, become active members on resuming

Scheme employment;

(d) a

person who at any time after 1st January 2019 becomes an active member of the

Scheme by virtue of Regulation 4 of the Transitional Regulations (change

of category of membership).

(2) The contribution rates specified in sub-paragraphs (3), (4) and (5) shall apply from 1st January 2016 until

the scheme year ending 31st December 2023.

(3) An

employer shall pay contributions of an amount equivalent to 16% of the total

aggregated pensionable earnings of the members employed by that employer.

(4) An

ordinary member of the Scheme shall pay contributions of an amount equivalent

to 7.75% of his or her pensionable earnings.

(5) A

uniformed member of the Scheme shall pay contributions of an amount equivalent

to 10.10% of his or her pensionable earnings.

(6) Subject to sub-paragraph (7), following the valuation as at

31st December 2021, adjusted rates (if any) specified in the rates and

adjustments certificate under Regulation 3(6)(c) shall, in accordance with

Regulation 6, be applied for the scheme year beginning on 1st January 2024.

(7) If

as a result of the valuation as at 31st December 2021 any of the

rates specified in sub-paragraphs (3), (4) and (5) do not require an

adjustment to be specified in the rates and adjustments certificate under Regulation 3(6)(c),

such rates shall continue to have effect on 1st January 2024 until

such time as those rates are adjusted following any subsequent valuation, and

applied in accordance with Regulation 6.

5 1967 Scheme –

employer

and member contribution rates until 31st December 2018

(1) This

paragraph applies to –

(a) employers

of contributing members of the 1967 Scheme; and

(b) contributing

members of the 1967 Scheme.

(2) The

contribution rates specified in sub-paragraphs (3) and (4) shall apply from 1st January 2016 until

the scheme year ending 31st December 2018.

(3) An

employer shall pay contributions of an amount equivalent to 13.60% of the

total aggregated pensionable earnings of the members employed by that employer.

(4) Contributing

members of the 1967 Scheme in respect of whom the Regulations

specified in column 1 of the Table apply, shall pay contributions of an amount equivalent to the percentage of

pensionable earnings specified in column 2 of the Table –

|

1

1967 Scheme Regulations

|

2

Percentage of pensionable earnings

|

|

1967 Regulations

|

6%

|

|

1992 Regulations

|

6%

|

|

Existing Members Regulations

|

6.25%

|

|

New Members Regulations

|

5%

|

(5) As

at 1st January 2019 –

(a) employers

shall pay contributions in accordance with Schedule 4;

(b) contributing members of the 1967 Scheme

who become transition members of the Scheme shall pay

contributions in accordance with Schedule 2; and

(c) contributing members of the 1967 Scheme

who remain as continuing members of that scheme shall

pay contributions in accordance with Schedule 3.

SCHEDULE 2

(Regulation 13)

transition

members – Transitional contribution rates

1 Application

and interpretation

This Schedule sets out

the contribution rates applicable to transition members.

2 Ordinary

member contribution rates

(1) This

sub-paragraph applies to transition members who –

(a) were

members of the 1967 Scheme under the New Members Regulations;

(b) were

not category A, category B or category C members, and

who become ordinary

members of the Scheme.

(2) The

transition members to whom sub-paragraph (1) applies, shall, in respect of

each scheme year specified in column 1 of Table 1, pay contributions

based on the salary applicable to the person as at the date, and at the

percentage rate specified in columns 2 and 3 of that

Table –

|

Table

1

|

|

1

Scheme

year

|

2

Full-time

equivalent basic annual salary: under £30,000 as at 31st December 2018

|

3

Full-time

equivalent basic annual salary: £30,000 and over as at 31st December 2018

|

|

2019

|

5.75%

|

6%

|

|

2020

|

6.50%

|

7%

|

|

2021

|

7.25%

|

7.75%

|

|

2022 up to and including 2023

|

7.75%

|

7.75%

|

(3) This

sub-paragraph applies to transition members who –

(a) were

members of the 1967 Scheme under the Existing Members Regulations;

(b) were

not category A or category B members, and

who become ordinary

members of the Scheme.

(4) The

transition members to whom sub-paragraph (3) applies, shall, in respect of

each scheme year specified in column 1 of Table 2, pay contributions

based on the salary applicable to the person as at the date, and at the

percentage rate specified in columns 2 and 3 of that Table –

|

Table 2

|

|

1

Scheme year

|

2

Full-time equivalent basic annual salary: under £30,000 as

at 31st December 2018

|

3

Full-time equivalent basic annual salary: £30,000 and over

as at 31st December 2018

|

|

2019

|

6.69%

|

6.84%

|

|

2020

|

7.13%

|

7.43%

|

|

2021

|

7.57%

|

7.75%

|

|

2022 up to and including 2023

|

7.75%

|

7.75%

|

(5) This

sub-paragraph applies to transition members who were members of the 1967 Scheme

under –

(a) the

1967 Regulations in respect of whom Regulation 17, 18, 19, 20 or 20A

of the 1967 Regulations did not apply; or

(b) the

1992 Regulations, and

who become ordinary

members of the Scheme.

(6) The

transition members to whom sub-paragraph (5) applies, shall, in respect of

each scheme year specified in column 1 of Table 3, pay contributions

based on the salary applicable to the person as at the date, and at the

percentage rate specified in columns 2 and 3 of that Table –

|

Table

3

|

|

1

Scheme

year

|

2

Full-time

equivalent basic annual salary: under £30,000 as at 31st December 2018

|

3

Full-time

equivalent basic annual salary: £30,000 and over as at 31st December 2018

|

|

2019

|

6.50%

|

6.67%

|

|

2020

|

7%

|

7.34%

|

|

2021

|

7.50%

|

7.75%

|

|

2022 up to and including 2023

|

7.75%

|

7.75%

|

3 Uniformed

member contribution rates

(1) This

sub-paragraph applies to transition members who –

(a) were

members of the 1967 Scheme under the New Members Regulations;

(b) were

category A, category B or category C members, and

who become uniformed

members of the Scheme.

(2) The

transition members to whom sub-paragraph (1) applies, shall, in respect of

each scheme year specified in column 1 of Table 1, pay contributions

of an amount equivalent to the percentage of pensionable earnings specified in

column 2 of that Table –

|

Table

1

|

|

1

Scheme

year

|

2

Percentage

of pensionable earnings

|

|

2019

|

6.02%

|

|

2020

|

7.04%

|

|

2021

|

8.06%

|

|

2022

|

9.08%

|

|

2023

|

10.10%

|

(3) This

sub-paragraph applies to transition members who were category A or

category B members of the 1967 Scheme under the Existing Members

Regulations and who become uniformed members of the Scheme.

(4) The

transition members to whom sub-paragraph (3) applies, shall, in respect of

each scheme year specified in column 1 of Table 2, pay contributions

of an amount equivalent to the percentage of pensionable earnings specified in

column 2 of that Table.

|

Table

2

|

|

1

Scheme

year

|

2

Percentage

of pensionable earnings

|

|

2019

|

7.02%

|

|

2020

|

7.79%

|

|

2021

|

8.56%

|

|

2022

|

9.33%

|

|

2023

|

10.10%

|

(5) This

sub-paragraph applies to transition members who were members of the 1967 Scheme

in respect of whom Regulation 17, 18, 19, 20 or 20A of the 1967 Regulations

applied, and who become uniformed members of the Scheme.

(6) The

transition members to whom sub-paragraph (5) applies, shall, in respect of

each scheme year specified in column 1 of Table 3, pay contributions

of an amount equivalent to the percentage of pensionable earnings specified in

column 2 of that Table –

|

Table 3

|

|

1

Scheme year

|

2

Percentage of pensionable earnings

|

|

2019

|

6.82%

|

|

2020

|

7.64%

|

|

2021

|

8.46%

|

|

2022

|

9.28%

|

|

2023

|

10.10%

|

4 Contribution

rates from 1st January 2024

If, as a result of the valuation as at 31st December 2021, any of

the contribution rates specified in this Schedule applicable for the scheme

year 2023 do not require an adjustment to be specified in the rates and

adjustments certificate under Regulation 3(6)(c), any such rates shall

continue to have effect for the scheme year beginning on

1st January 2024 until such time as those rates are adjusted

following any subsequent valuation, and applied in accordance with

Regulation 6.

SCHEDULE 3

(Regulation 14)

1967 scheme –

continuing members Transitional contribution rates

1 Application

and interpretation

(1) This

Schedule sets out the contribution rates applicable to continuing members of

the 1967 Scheme.

(2) In

this Schedule –

“members” in

relation to the 1992 Regulations has the same meaning as in

Regulation 1 of those Regulations;

“members” in

relation to the Existing Members Regulations and New Members Regulations has

the same meaning as in Regulation 1 of those Regulations.

2 1967 Regulations –

contributory member contribution rates

(1) Contributory

members in respect of whom Regulation 17, 18, 19, 20 or 20A of the

1967 Regulations does not apply, shall, in respect of each scheme year

specified in column 1 of Table 1, pay contributions based on the

salary applicable to the person as at the date, and at the percentage rate specified

in columns 2 and 3 of that Table –

|

Table

1

|

|

1

Scheme

year

|

2

Full-time

equivalent basic annual salary: under £30,000 as at 31st December 2018

|

3

Full-time

equivalent basic annual salary: £30,000 and over as at 31st December 2018

|

|

2019

|

6.50%

|

6.67%

|

|

2020

|

7%

|

7.34%

|

|

2021

|

7.50%

|

7.75%

|

|

2022 up to and including 2023

|

7.75%

|

7.75%

|

(2) Contributory

members in respect of whom Regulation 17, 18, 19, 20 or 20A of the

1967 Regulations applies, shall, in respect of each scheme year specified

in column 1 of Table 2, pay contributions of an amount equivalent to

the percentage of pensionable earnings specified in column 2 of that Table –

|

Table 2

|

|

1

Scheme year

|

2

Percentage of pensionable earnings

|

|

2019

|

6.82%

|

|

2020

|

7.64%

|

|

2021

|

8.46%

|

|

2022

|

9.28%

|

|

2023

|

10.10%

|

3 1992 Regulations –

member contribution rates

Members in respect of

whom the 1992 Regulations apply, shall, in respect of each scheme year

specified in column 1 of the Table, pay contributions based on the salary

applicable to the person as at the date, and at the percentage rate specified in

columns 2 and 3 of the Table –

|

1

Scheme

year

|

2

Full-time

equivalent basic annual salary: under £30,000 as at 31st December 2018

|

3

Full-time

equivalent basic annual salary: £30,000 and over as at 31st December 2018

|

|

2019

|

6.50%

|

6.67%

|

|

2020

|

7%

|

7.34%

|

|

2021

|

7.50%

|

7.75%

|

|

2022 up to and including 2023

|

7.75%

|

7.75%

|

4 Existing

Members Regulations – member contribution rates

(1) This

paragraph applies to members in respect of whom the Existing Members

Regulations apply.

(2) Members

who are not category A or category B members, shall, in respect of

each scheme year specified in column 1 of Table 1, pay contributions

based on the salary applicable to the person as at the date, and at the

percentage rate specified in columns 2 and 3 of that Table –

|

Table 1

|

|

1

Scheme year

|

2

Full-time equivalent basic annual salary: under £30,000 as at

31st December 2018

|

3

Full-time equivalent basic annual salary: £30,000 and over

as at 31st December 2018

|

|

2019

|

6.69%

|

6.84%

|

|

2020

|

7.13%

|

7.43%

|

|

2021

|

7.57%

|

7.75%

|

|

2022 up to and including 2023

|

7.75%

|

7.75%

|

(3) Category A

or category B members, shall, in respect of each scheme year specified in

column 1 of Table 2, pay contributions of an amount equivalent to the

percentage of pensionable earnings specified in column 2 of that

Table –

|

Table

2

|

|

1

Scheme

year

|

2

Percentage

of pensionable earnings

|

|

2019

|

7.02%

|

|

2020

|

7.79%

|

|

2021

|

8.56%

|

|

2022

|

9.33%

|

|

2023

|

10.10%

|

5 New

Members Regulations – member contribution rates

(1) This

paragraph applies to members in respect of whom the New Members Regulations apply.

(2) Members

who are not category A, category B or category C members, shall,

in respect of each scheme year specified in column 1 of Table 1, pay contributions

based on the salary applicable to the person as at the date, and at the

percentage rate specified in columns 2 and 3 of that Table –

|

Table 1

|

|

1

Scheme year

|

2

Full-time equivalent basic annual salary: under £30,000 as

at 31st December 2018

|

3

Full-time equivalent basic annual salary: £30,000 and over

as at 31st December 2018

|

|

2019

|

5.75%

|

6.00%

|

|

2020

|

6.50%

|

7.00%

|

|

2021

|

7.25%

|

7.75%

|

|

2022 up to and including 2023

|

7.75%

|

7.75%

|

(3) Category A,

category B or category C members, shall, in respect of each scheme

year specified in column 1 of Table 2, pay contributions of an amount

equivalent to the percentage of pensionable earnings specified in column 2

of that Table –

|

Table

2

|

|

1

Scheme

year

|

2

Percentage

of pensionable earnings

|

|

2019

|

6.02%

|

|

2020

|

7.04%

|

|

2021

|

8.06%

|

|

2022

|

9.08%

|

|

2023

|

10.10%

|

6 Contribution

rates from 1st January 2024

If, as a result of the valuation as at 31st December 2021, any of the

contribution rates specified in this Schedule applicable for the scheme

year 2023 do not require an adjustment to be specified in the rates and

adjustments certificate under Regulation 3(6)(c), any such rates shall

continue to have effect for the scheme year beginning on

1st January 2024 until such time as those rates are adjusted

following any subsequent valuation, and applied in accordance with

Regulation 6.

SCHEDULE 4

(Regulation 15)

employer

Transitional contribution rates

(1) This

Schedule applies to employers referred to in Regulation 15(1) who shall in

respect of each scheme year specified in column 1 of the Table, pay

contributions of an amount equivalent to the percentage of pensionable earnings

specified in column 2 of the Table –

|

1

Scheme year

|

2

Percentage of pensionable earnings of continuing members

of the 1967 Scheme; or transition members

|

|

2019

|

14.40%

|

|

2020

|

15.20%

|

|

2021 up to and including 2023

|

16%

|

(2) If, as a result of the valuation as at

31st December 2021, the contribution rate specified in this Schedule

applicable for the scheme year 2023 does not require an adjustment to be

specified in the rates and adjustments certificate under Regulation 3(6)(c),

that rate shall continue to have effect for the scheme year beginning on

1st January 2024 until such time as that rate is adjusted following

any subsequent valuation, and applied in accordance with Regulation 6.

SCHEDULE 5[14]

(Regulation 20)

re-payment

of pre-1988 liability

(1) In this Schedule –

“1967 Scheme employer” means an

employer who before 1st January 2016 was –

(a) admitted

to the 1967 Scheme under repealed Regulation 9 of the General

Regulations; or

(b) treated

as if admitted to the 1967 Scheme under any enactment which provided

for that employer to become an employer for the purposes of that scheme in

respect of members of that scheme whose employment with the States Employment

Board was transferred to that employer;

“pre-1988 liability”, in respect of the States Employment Board,

means so much of the capitalized value from time to time of the debt

transferred to the fund in respect of the 1967 Scheme when that

scheme was amended with effect from 1st January 1988 that is

attributable to the States Employment Board, being an amount calculated by the

Actuary to be £280,268,529 as at 31st December 2014;

“administration of

the States” has the meaning given in Article 1 of the Employment

of States of Jersey Employees (Jersey) Law 2005;

“admitted employer” means an employer other than the States

Employment Board;

(a) who

in relation to the Scheme –

(i) is admitted to

the Scheme under Regulation 7 of, and paragraph 2(1) of Schedule 1

to, the Membership and Benefits Regulations,

(ii) is

admitted to the Scheme under Regulation 16(1) of the Transitional

Regulations,

(iii) is

admitted to the Scheme under Article 10(5) of the Law, or

(iv) is

treated as if admitted to the Scheme under any enactment which provides for

that employer to become an employer for the purposes of the Scheme in respect

of members of the Scheme whose employment with the States Employment Board is

transferred to that employer; and

(b) who,

on or after 1st January 2016, is treated as if admitted to the 1967 Scheme

under Regulation 7 of, and paragraph 2(5) of Schedule 1 to, the Membership

and Benefits Regulations;

“debt payment period” means the period that started on

1st January 2002 and ends on 29th September 2053 (both

dates being part of the period);

“member” means a contributing, deferred or pensioner member of

the 1967 Scheme, and the widow or widower or surviving civil partner,

child or dependant of a such a member.

(2) The

States Employment Board shall on 1st January 2016 continue to pay off its

pre-1988 liability for the remaining term of the debt payment period.

(3) The

States Employment Board shall do so without –

(a) the

imposition of an obligation on members;

(b) an

adverse effect on the benefits received or to be received by members; or

(c) an

increase in the contributions paid or to be paid by members.

(4) To

pay off its pre-1988 liability the States Employment Board shall during the

remaining term of the debt payment period, pay to the fund by equal monthly

contributions payable before the end of each month –

(a) for

the year commencing on 1st January 2016, an amount equivalent to –

(i) the

sum of £4,406,724, increased by the same percentage increase as the

average percentage increase in 2014 and 2015 in the pensionable earnings of those contributing members who were employed by the States Employment

Board during the whole of those years, adjusted to take account of any

extinguished liability where in 2015 a 1967 Scheme employer has –

(A) replaced an

administration of the States, and

(B) paid

such capital amount into the fund as is required to settle such portion of the

pre-1988 liability as is attributable to that employer by reason of becoming a 1967 Scheme

employer who has replaced an administration of the States, and

(ii) the

sum of £3,000,000 pursuant to a decision of the States to adopt P.69/2012

in respect of the medium term financial plan approved under the Public Finances (Jersey) Law 2005, increased by the same percentage increase as the

average percentage increase in 2015 in the pensionable

earnings of those

contributing members who were employed by the States Employment Board during

the whole of that year; and

(b) for

each subsequent year, the amount payable during the previous year increased by

the same percentage increase as the average percentage increase during that

previous year in the pensionable earnings of those members

of the respective schemes who were employed by the States Employment

Board during the whole of that year.

(5) The

States Employment Board may at any time –

(a) extinguish

its liability to make contributions in accordance with paragraph (4) by

paying to the fund a contribution equal to the amount of its pre-1988 liability

at that time, as determined by the Actuary;

(b) reduce

its pre-1988 liability by paying any amount to the fund, either as a lump sum

contribution or by way of increased contributions; or

(c) reduce

the length of the debt payment period where the fund has received payment of a

capital amount at any time after 1st January 2016, in respect of an admitted employer who –

(i) has replaced an administration of the States, and

(ii) has

paid such capital amount into the fund as is required to settle such portion of

the pre-1988 liability as is attributable to that employer by reason of

becoming an admitted employer who has replaced an administration of the States.

(6) Where –

(a) the

States Employment Board makes a contribution to the fund in accordance with paragraph (5)(b);

(b) the 1967 Scheme

is amended to end or adjust any future benefit accrual for any members;

(c) the

Actuary determines that there has been a change of circumstances of the 1967 Scheme

or an event, which need not be connected with that scheme, that has made

compliance by the States Employment Board with paragraph (4) inadequate to

ensure that both paragraphs (2) and (3) are complied with; or

(d) the

Actuary determines that there has been a change that makes the debt re-payment

provisions of this Schedule unacceptable as an asset of the 1967 Scheme

for the purposes of a valuation in accordance with Regulation 3,

the States Employment Board shall, after receiving the comments of the

Committee acting on the advice of the Actuary, propose to the States amendments

to this Schedule that are adequate to ensure that both paragraphs (2) and

(3) are complied with.

(7) The

proposition –

(a) may,

amongst other things, propose a variation in the length of the debt payment

period or a variation in the amount of the contributions to be paid by the

States Employment Board; but

(b) shall

not propose an amendment of paragraph (3).